While traditional cryptocurrencies continue their characteristic dance between euphoria and despair, PayPal has introduced PYUSD—a stablecoin that promises the revolutionary potential of digital currency without the stomach-churning volatility that sends Bitcoin evangelists into existential spirals.

PYUSD, developed by PayPal and issued through Paxos Trust Company, maintains a steadfast 1:1 peg to the U.S. dollar through backing by dollar deposits, treasuries, and equivalent cash instruments. This arrangement eliminates the peculiar phenomenon where purchasing coffee might cost dramatically different amounts depending on whether the transaction occurs during a crypto rally or rout.

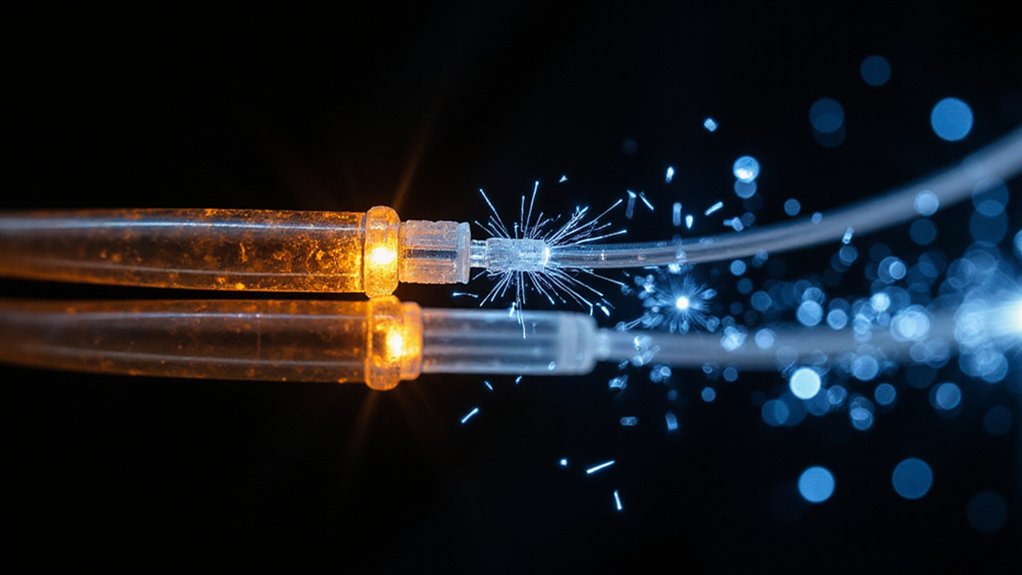

Operating on Ethereum’s blockchain, PYUSD leverages smart contracts and decentralized infrastructure while maintaining the regulatory compliance that institutional adopters find reassuring. These smart contracts execute transactions automatically without human intervention, representing autonomous financial machinery that enables unprecedented efficiency.

The stablecoin’s integration into PayPal’s ecosystem creates a rather compelling value proposition for merchants weary of traditional payment processing complexities. Businesses can now accept payments from over 100 different cryptocurrencies through PayPal’s Pay with Crypto initiative, which connects seamlessly with popular wallets including Coinbase, MetaMask, and Binance. This broad compatibility transforms what was previously a fragmented landscape into a unified payment gateway—assuming customers can navigate the bewildering array of wallet interfaces without inadvertently sending funds to blockchain purgatory.

Within PayPal and Venmo ecosystems, PYUSD transfers occur without network fees, facilitating instant peer-to-peer transactions that bypass conventional banking delays. For merchants, this translates to reduced transaction costs and expanded payment options that potentially attract crypto-native customers who previously faced friction converting digital assets for purchases.

The Ethereum foundation enables PYUSD participation in decentralized finance protocols, allowing businesses to engage with lending platforms, liquidity pools, and trading mechanisms using a stable asset rather than volatile alternatives. This stability proves particularly valuable for cross-border commerce, where traditional payment rails often impose significant delays and fees. Paxos conducts regular audits to ensure transparency and maintain the stability of PYUSD reserves, providing additional security assurance for business adopters. PayPal’s extensive user base of 400 million users provides immediate access to a vast customer ecosystem for businesses adopting PYUSD.

PayPal’s global merchant network—encompassing millions of businesses—suddenly gains access to cryptocurrency payments without requiring separate crypto infrastructure investments. The stablecoin fundamentally functions as a bridge between traditional commerce and digital assets, offering the technological advantages of blockchain transactions while maintaining the familiar stability of dollar-denominated commerce.

Whether this represents genuine innovation or merely digital window dressing on conventional payments remains an open question.